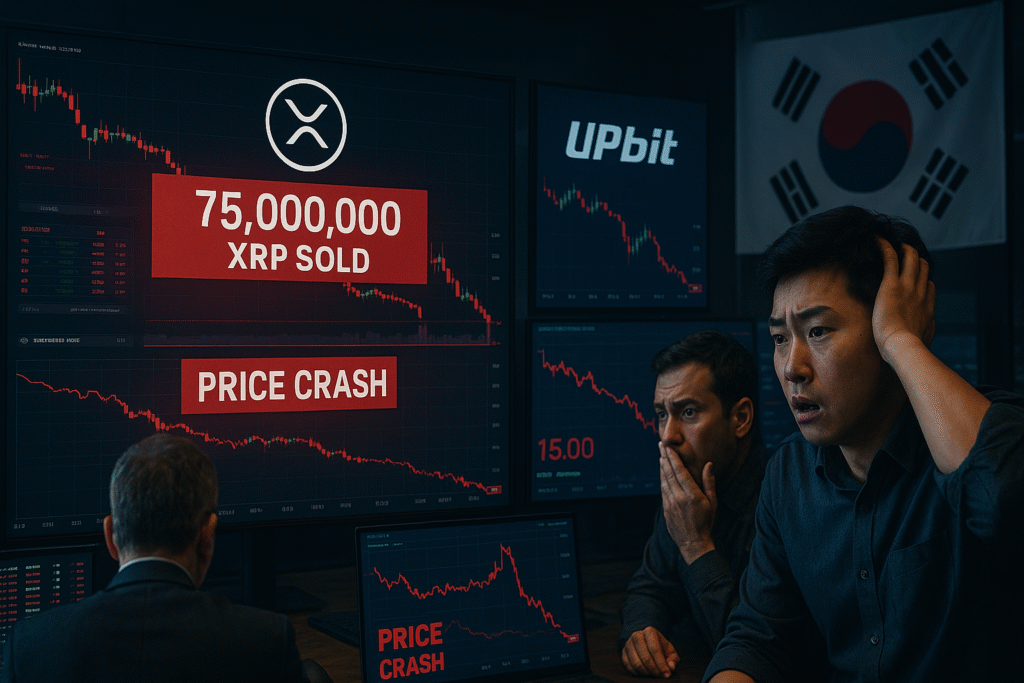

Upbit dumps 75 million XRP in a shocking move that sent ripples through the crypto community on July 24, 2025. This massive offload by one of South Korea’s largest crypto exchanges led to a swift 15 percent crash in XRP’s price, wiping out over $90 million in leveraged long positions in a matter of hours. The sudden volatility stunned traders, many of whom were riding high on XRP’s recent rally.

The crypto market is no stranger to turbulence, but this particular incident caught many off guard. In this article, we’ll break down what happened, why Upbit dumped 75 million XRP, how it impacted the market, and what this could mean for investors and XRP holders moving forward.

What Happened When Upbit Dumps 75 Million XRP

The crypto world woke up to chaos when Upbit dumps 75 million XRP during high-volume trading hours. The move was abrupt and triggered an immediate reaction in the markets. Within minutes, XRP’s price fell from approximately $3.65 to $3.10, representing a steep 15 percent decline.

Traders scrambled to respond, but the sell pressure overwhelmed buy orders across multiple exchanges. This resulted in a cascade of liquidations totaling more than $90 million. The majority of these were leveraged long positions, highlighting the risk of overexposure in a volatile market.

This was not a flash crash. The dump appeared intentional, as the tokens were sold in large batches. Blockchain analysts also confirmed unusually high transfer volumes from Upbit’s wallets just before the price dip, further solidifying the theory that the platform was responsible.

Why Did Upbit Dump 75 Million XRP?

One of the biggest questions on everyone’s mind is: why would a major exchange like Upbit dump 75 million XRP in a single move?

There are several theories, none officially confirmed, but widely circulated:

- Liquidity management: Exchanges sometimes sell assets to adjust their holdings and meet liquidity demands for withdrawals, margin calls, or compliance.

- Internal risk management: With XRP reaching a 7-year high, Upbit might have viewed this as a strategic opportunity to secure profits.

- Regulatory pressure: South Korean regulators have tightened scrutiny around large crypto holdings and transactions. The dump could be related to preemptive compliance measures.

- Wallet rebalancing gone wrong: Some believe the dump might have been an internal wallet rebalance that unintentionally triggered massive automated sell-offs.

Regardless of the reason, the outcome was clear as Upbit dumps 75 million XRP and the market suffers as a result.

Market Reactions to the 75 Million XRP Dump

The fallout from this event was immediate. XRP trading pairs on multiple platforms experienced extreme slippage. Analysts and influencers across Twitter and YouTube reacted strongly, with many criticizing Upbit for poor timing and lack of transparency.

Sentiment toward XRP turned bearish almost overnight. While the token had previously shown strong momentum, the massive dump raised concerns about centralized influence on decentralized markets. Traders also expressed frustration with the lack of pre-warning or communication from Upbit.

Despite the backlash, XRP recovered slightly, closing the day down about 5 percent at $3.16. But the psychological damage was already done. When Upbit dumps 75 million XRP, it sends a message that no asset is immune to sharp and unexpected corrections, especially when large centralized players are involved.

Upbit Dumps 75 Million XRP: Impact on Leverage Traders

For leverage traders, the incident was devastating. The 15 percent dip happened so quickly that many positions were liquidated before traders could respond. On-chain analytics firm Lookonchain reported that over $90 million in long positions were wiped out within an hour of the dump.

This raises deeper concerns about the use of leverage in crypto markets. While leverage can amplify gains, it also exposes traders to catastrophic losses during black swan events like this one. When Upbit dumps 75 million XRP, the ripple effect is not just figurative, it is literal, and many traders learned that lesson the hard way.

Technical Indicators Before and After the XRP Dump

Interestingly, there were a few subtle signs that something big was brewing. Analysts noted a sharp increase in XRP deposits into Upbit wallets in the 12 hours leading up to the event. Additionally, open interest in XRP futures reached multi-month highs, signaling overcrowded bullish positions.

After Upbit dumps 75 million XRP, those technicals shifted dramatically. XRP’s RSI (Relative Strength Index) plunged from overbought levels to near-neutral. Trading volume spiked, but largely on the sell side. The MACD also flipped bearish for the first time in weeks.

This underscores the importance of monitoring exchange inflows and outflows, especially for tokens with recent bullish momentum. Sometimes, what looks like strength is actually the calm before the dump.

How Should Investors React Now?

If you’re holding XRP or considering an entry, the key is to stay rational. Yes, Upbit dumps 75 million XRP and the market reacted harshly, but fundamentals haven’t changed overnight.

Here are a few strategic steps investors might consider:

- Wait for stabilization: Let the market digest the news and allow price action to stabilize before making new entries.

- Use smaller position sizes: Reduce exposure to avoid large losses from unpredictable dumps.

- Watch wallet activity: Tools like Whale Alert and Lookonchain help monitor exchange-related wallet movements.

- Avoid excessive leverage: This event proved how dangerous leverage can be when central entities control large token supplies.

Ultimately, XRP remains a widely-used asset with a loyal community. But this event is a reminder that in crypto, vigilance is everything.

Conclusion

When Upbit dumps 75 million XRP, the entire market feels it. From panic selling and liquidations to loss of trust, the implications stretch far beyond one exchange and one token. It exposes the fragility of crypto ecosystems where a single actor can move billions of dollars worth of value with little warning.

This event should be a wake up call not just for XRP investors but for the entire crypto community. It highlights the risks of centralization in a space built on decentralization. Whether you are a day trader or a long term trader, this incident shows that preparation and awareness are critical.

Crypto is still growing, evolving, and maturing. But until exchanges like Upbit take more transparent and user-centered approaches, we may continue to see moments where Upbit dumps 75 million XRP, and the rest of us pay the price.